When buying or selling rare coins you need to keep some basic rules in mind. These rules can have a direct and significant impact on the health of your bank or crypto account.

Here is my list of the 10 most important coin-collecting and investing pointers.

1. Know a Coin’s Value; It’s Your Best Way to Negotiate a Price

Buyers are often advised to start by offering the seller a set percentage below the asking price. This disregards that the asking price could be far above the coin’s true market value.

If a coin is worth $1,000 and someone is asking $10,000 for it, you wouldn’t want to offer $5,000. On the other hand, if a coin is worth $1,000 and someone is offering it for $50, you wouldn’t want to jeopardize the deal by haggling to get the price down to $25. You would simply say, “Okay, $50 is fine,” buy it for $50 and sell it for $1,000.

If you don’t know what a coin is worth, you shouldn’t be negotiating for it in the first place. If you do know what it’s worth, you have a big edge over other people who don’t.

GETTY IMAGES / NATTAPOL SRITONGCOM / EYEEM

2. Be Decisive and Take Action

Quick action pays big dividends in the coin market.

If you feel a coin you bought has been overgraded or misrepresented, act quickly to return it. The longer you wait, the less chance you’ll have of getting your money back and the greater the chance your return privilege will expire.

Conversely, if you have a coin that rises in value quickly, go to the cash window and celebrate. Sell it and take your profit. Don’t wait.

3. Become a Collector/Investor

The collector/investor is the emerging breed of coin buyer and will be, in years to come, the predominant breed of consumer in this industry. To maximize your success as a coin buyer, you will need to possess a collector and an investor mentality. It’s not to your advantage to be exclusively one or the other.

Collectors willing to pay the price required to secure a wanted coin can be decisive and even override my advice and pay the piper. If you’re a collector, I recommend you learn all you can about coins’ financial implications. If you have a coin that’s a duplicate in your collection, sell it and see how it feels to make a profit. If you’re an investor, you should learn about the cultural aspects of coins and learn to appreciate them as works of art. You’ll gain an understanding of why other people value them and help in assessing their value yourself.

4. Buy Low and Sell High

If coins are increasing in value, you should sell into rallies. If coins have declined dramatically in a very short time, that might be a good time to buy

In general, I recommend you cost-average. Few can outguess the marketplace; for that reason, you should buy your coins systematically over time. If you have $100,000 to spend, don’t spend it all right now thinking you can outguess the marketplace. Again, few can. Take $10,000 or $20,000 a month and spend it that way.

5. Make Sure You Have the Coins

Many people buy coins as commodities. They may order a thousand 1881-S Morgan dollars certified as Mint State-65, yet never open the box. When the time comes to sell, they may open the box and discover they have only 575.

If you buy rolls of coins, make sure that you get full rolls. If you lend one of your rolls to someone to look at the coins, make sure to count the coins after they are examined. You can’t count your profits if you can’t count your coins.

COURTESY IAN RUSSELL

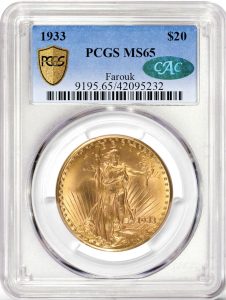

6. Resubmit Undergraded Slabbed Coins to Grading Services

If you have a high-end certified coin that is close to being the next-highest grade or perhaps really is the higher grade, it would be to your advantage financially to resubmit it to a grading service. By getting it recertified in the next higher grade, you might reap an instant profit of several thousand dollars.

You can crack it out of its holder if you want the grading service to have a fresh look at it. But beware: If the coin isn’t as nice as you thought, it might get downgraded (graded lower). So your better option might be to submit it for reconsideration intact, without removing it from the holder.

7. Stay Informed

Knowledge is power. If you’re not informed, when it comes time to go to the cash window and celebrate, or when there’s a significant buying opportunity, you’re likely to miss the boat.

8. Get Rid of Underperformers and Junk

Take all your off-grade modern rolls, all your common coins, all your out-and-out junk and sell them. Consolidate. Better coins offer far greater economic opportunities. Coins that are scarce today can become rare in the future, and coins that are rare today can become rarer. Coins that are common now will remain common.

9. Be Certain That Every Coin You Have That can be Independently Certified has Been Independently Certified

Certification is important in the current marketplace.

Many buyers and sellers won’t accept coins unless they’re certified. The grading companies serve a vital role by providing informed judgments on rare coins’ level of preservation and, in most instances, guaranteeing the accuracy of those judgments. They remove the guesswork and much of the risk. Keep in mind that when you buy certified coins, you’re paying for the coin and not the plastic. The certification gives the coin greater liquidity, but the coin should also stand on its own merits. The certification should serve to reinforce desirability.

10. Store Your Coins Properly

If you buy a coin for $100,000, drop it on the street on the way home and it gets a scratch on it, it may be worth only $10,000 by the time you get home.

Your coins can suffer serious, permanent damage after you get them home. Make sure to store your coins in a dry, stable environment and, if possible, make sure that each coin’s surface is free from airborne pollutants before you put the coins in long-term storage.

You also need to properly handle your coins. When removing coins from holders that have staples in them, always remove the staples first. Never use your bare fingers to hold the front or back of a coin. Always hold the coin tightly by its edges.

You owe it to future collectors to maintain your coins in good condition. You also owe it to yourself. If you don’t, you’ll pay a heavy penalty financially.

This article about top 10 coin collecting and investment tips previously appeared in COINage magazine. To subscribe click here. Article by Scott Travers.