By Donn Pearlman

Purchasing coins became a heck of a lot more complicated for many dealers and auction houses, and potentially more expensive for collectors, because of a U.S. Supreme Court case last year known as South Dakota vs. Wayfair. As the Industry Council for Tangible Assets (ICTA) points out, the court’s decision has allowed states to collect sales taxes from out-of-state merchants who sell products – such as rare coins and bank notes – to buyers in their states.

More than two dozen states already are enforcing remote sales tax collection, and the worrisome issue is of crucial importance to the hobby.

It could get even worse. Some states have been working together to urge Congress to create federal legislation for a sales tax law that would grant states the power to force out-of-state merchants to collect and remit sales taxes for each state. But wait; there’s more. A provision in this horrible plan could eliminate many existing sales-tax exemptions for precious metals and rare coins.

Even without that proposed law, the Supreme Court’s ruling “has already created massive compliance problems for rare coin and precious metals-bullion dealers and their customers, just as it has for state governments, all small businesses and consumers nationwide,” warned ICTA Chairman John Fisher.

ICTA is a tax-exempt, national trade association for dealers of rare coins, currency, and precious metals bullion. One of its top priorities is to eliminate these onerous, new tax problems. That’s one reason the organization recently hired Jimmy Hayes to be its executive director. A veteran collector, lawyer, lobbyist for the numismatic profession, and former Louisiana congressman, Hayes understands the problems now facing collectors and dealers, and knows how to navigate legislative issues in Washington, D.C.

Individual collectors can show their support for ICTA’s vigorous efforts by becoming a Consumer Patron for as little as $25 a year. Membership information is available at www.ICTAonline.org.

Another group successfully eliminated one negative effect of the Supreme Court decision earlier this year when eBay erroneously imposed tax collections for sales to residents of a state where coins and precious metals items are exempt from such taxes. Members of a Facebook group called Coin Dealers Helping Coin Dealers and the group’s administrator, Rob Oberth, quickly worked with eBay to resolve that problem. But there is still the potential for burdensome compliance elsewhere for dealers, as well as higher prices collectors may have to pay because of sales taxes on items shipped to them from another state.

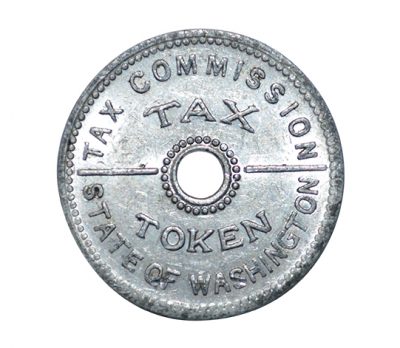

Perhaps the only thing “good” collectors can find about taxes is a numismatic legacy dating back to the 1930s. According to the Token and Medal Society, a dozen states once issued tokens to help facilitate sales tax collection. Some of the tokens were in denominations of just one-tenth of a cent (one mill). Depending on the state, tokens were issued in metal, plastic, fiber, and even cardboard.

While hundreds of city, county, and state governments nationwide find ways to collect tax, you can add an historic and inexpensive tax token or two to your collection. You can also support ICTA’s efforts to stop those government agencies from reaching for your wallet across state lines.

Donn Pearlman is a former American Numismatic Association Governor and recipient of dozens of writing and broadcasting awards.

Want to receive COINage magazine in your mailbox or inbox? Subscribe today!