Ron Guth is a recognized authority on the United States and a specialist in German coins. He has written or co-authored numerous books, several of which have garnered awards from the Professional Numismatists Guild and the Numismatic Literary Guild. He is a lifetime member of the American Numismatic Association (ANA) and a member of many state and regional organizations. When asked to describe what he does for a living, Ron answers, “I facilitate participation in numismatics.”

Fishing Tackle Inspired Coin Collecting

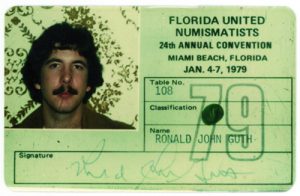

A native of Boston, Massachusetts, Ron spent his formative years in St. Petersburg, Florida and began collecting in the early 1960s. His introduction to coin collecting came about through a friend who visited his house carrying a tackle box. However, the box contained old coins instead of fishing tackle. From that moment, he was hooked, Ron explains. Like many other young collectors, he spent many a Saturday morning at the local bank, turning in his small allowance for rolls of coins, which were searched diligently for old silver or obsolete coins.

Over the years, the focus of his collecting efforts changed, shaped by experiences and interactions with fellow numismatists. For example, the theft of his collection in the early 1970s required that he start his collection anew and in doing so, he narrowed his focus to U.S. Half Cents, which he collected by die variety. Another significant shift in his collecting took place in the late 1980s when he was presented with a collection of German coins.

“I knew nothing about German coins, but I bought the deal hoping I could figure out a way to market it,” Ron reminisced. “The deal contained a lot of East German coins which were just starting to become popular due to the impending reunification of East and West Germany.”

A Career Centered on Coins

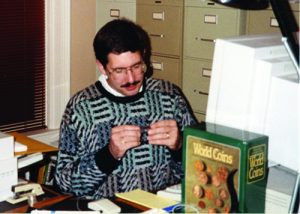

While he is a licensed Certified Public Accountant, during much of the past 40 years, his professional career has centered on coins. Whether he was on staff with a company or operating his own business, each opportunity has presented him with valuable lessons, ideas, knowledge, and inspiration. For example, while working at the Florida Coin Exchange, one of his first professional positions, he met his lifelong friend and frequent co-author, Jeff Garrett. And in the early 1980s, after Ron and his wife, Maggie, moved to Indiana, he did business as Ron Guth Rare Coins.

He also spent many years in the coin auction business, as both an owner and director. In 1999, he created the CoinFacts website (now PCGS CoinFacts). After selling the site, he went on to serve in various capacities with PCGS. In 2018, he formed Expert Numismatic Services, Inc. and created the Guth 100 Point Coin Grading ScaleSM.

Currently, he serves as the Executive Director of the Numismatic Literary Guild, which is a perfect fit for this prolific award-winning author, who is the recipient of various honors by the ANA, including the President’s Award. When he’s not focused on numismatic interests, this father and grandfather of three, soon to be four, enjoys sailing, gardening, hiking, and spending time with his wife and their grandchildren.

Professional Perspective

What is the future of coin collecting and investing?

Coin collecting and investing is alive and well. However, the coin market appears substantially different from decades ago simply because a lot of collecting and investing activities have moved from coin shows and brick-and-mortar businesses to the internet. Most of the up-and-coming young dealers (the demographic we most seek to attract) are coming up through Facebook groups, Instagram, and other social network platforms. The confidence afforded by third-party grading and the Certified Acceptance Corporation (CAC) has encouraged investing in coins. Certainly, we’ve lost many coin investors to the stock market in recent years, but as the stock market peaks, we’ll see more investors returning.

You can offer a unique perspective on coin grading and certification as the former president of the Professional Coin Grading Service (PCGS). How do you feel about grading services? Are they more helpful than hurtful to our hobby/industry?

Without a doubt, coin grading and certification have been very helpful to our hobby/industry. I’ve always maintained that coin grading and certification are as much about consumer protection as they are about assigning a grade to a coin. Everyone from my generation who collected coins in the sixties through the early eighties remembers the “buyer beware” mentality that prevailed in the market. Today, collectors enjoy protection from counterfeit, altered, or doctored coins, and they benefit from increased liquidity, better information, and a higher level of confidence that the grades assigned to their coins are accurate and have a higher level of acceptance in the market. Where once collectors had to negotiate over grade and price, now the haggling centers mostly on the price.

However, there is one caveat: Not all grading services are equal, and much harm has been caused by some lower-tier services that deliberately over grade and misrepresent the coins in their holders. Therefore, it is incumbent on the collector/investor to do due diligence and determine the grading services that are the most reputable.

Discussing Grading

Why did you make a push for a 100-point grading scale? Don’t we already have too many grades?

The purpose of the 100-point coin grading scale that I proposed back in 2017 was two-fold:

1) to finally develop a grading scale that was easy to understand and explain, and 2) to finally recognize, with whole numbers, the intermediate (plus grades) that are already in wide use. The problem, in my opinion, is not that we have too many grades. Rather, we have an old system from 1948 that has gone through numerous arbitrary modifications and which is puzzling to new collectors who cannot understand why our best grade of 70 looks like a “C” on a child’s report card.

The beauty of the 100-point coin grading scale that I proposed is that the old system can remain intact. Thus, the argument that the new system is a way for the grading companies to profit by re-grading all the millions of coins already in holders is inaccurate. Implementation of the new system can be driven by popular demand, not as a dictate from the grading companies. Complete information about the 100-point coin grading scale can be found at http://expertnumismatics.com

Are you willing to acknowledge that grading standards have evolved or changed over time? Please explain and justify your answer either way.

I’m unwilling to acknowledge that grading standards have evolved or changed over time because, by definition, a standard is something that should not change over time. However, the application of grading standards varies both between and within grading services. I can cite numerous examples where the same coin has received different grades from different services and/or different grades from the same service. Our hobby/industry calls this “grade-flation” as a catch-all phrase, but I’ve seen examples of both grade-inflation (where the grade goes up) and grade-deflation (where the grade goes down). To their credit, reputable grading services do their best to “get it right” and I do not believe there is a deliberate scheme to loosen grades over time.

Examining the Future

I know some great coin graders, but I know of no individual who can grade the same group of coins the exact same way every time. As the older graders from the early years of coin certification begin to retire, the job of the grading companies is to find and hire graders who can grade as consistently close to the standard as is humanly possible.

How do you feel about the Certified Acceptance Corporation (CAC)?

The Certified Acceptance Corporation (CAC) has become an important part of our hobby/industry since it was founded in 2007. According to CAC’s website, the CAC sticker means that “your coin has been verified as meeting the standard to strict quality within its grade.” As a result, many collectors find comfort in this extra assurance and will pay more for coins with CAC stickers. In my opinion, anything that adds confidence to our hobby/industry is positive.

How did CoinFacts.com come about, and how do you feel about its current direction?

I started CoinFacts.com in 1999, back when there was very little information about U.S. coins on the Internet. Today, it is one of the most important numismatic resources on the Internet. Collectors Universe (parent company of the Professional Coin Grading Service) purchased CoinFacts in 2004, re-named it PCGS CoinFacts.com, and poured considerable resources into its development. I am no longer involved with PCGS except as a consultant, so I no longer have any control over the direction of PCGS CoinFacts, but I am sure PCGS will continue to recognize its importance to its brand.

Goals for the Guild

What is the future of numismatic literature and journalism, and what are your top two goals as the newly-appointed executive director of the prestigious Numismatic Literary Guild?

This is an area that has undergone huge changes in the last several years. For instance, the Newman Numismatic Portal has scanned many of the old coin reference books and auction catalogs and has made them available for free. As a result, I no longer need walls of books and catalogs for my research, which has made my wife happy, but I fear the value of old numismatic literature may be dropping as a result. Many authors have turned to electronic self-publishing or on-demand publishing as an alternative to traditional print publishing. Quite a few authors have created interesting video blogs and podcasts because of the broad reach of social platforms such as YouTube and Facebook.

Print publications seem to be struggling as more and more people get their information from the Internet. So, while the face of numismatic literature and journalism is changing, I believe that we now have more people writing and providing information than ever before.

The now fifty-one-year-old Numismatic Literary Guild (NLG) has undergone similar changes. Most of our board meetings are handled entirely by email and voice, and virtually all of our communications with our members are sent by email or through our website. Our membership list is now “in the cloud”, eliminating transcription errors and allowing real-time recording of dues payments, address changes, and corrections. My first-year as Executive Director of the NLG is nearly over and my new goals are to expand the membership, increase member participation, and continue to recognize and honor some of the best writers in numismatics.

How does transparency in auction prices realized affect dealer profit margins?

I’m all for transparency in auction prices realized (APR) because I believe that the best customer is an informed customer. However, the coin hobby/industry is one of the few places where there is little or no distinction between wholesale sellers and retail buyers. They all work off the same price guides. Because access to APR data is so transparent and so readily available, it is perhaps too easy for a collector to see what a dealer has paid for a coin, then use that information as a blunt instrument to reduce the dealer’s profit.

A popular misconception is that a fresh APR is the new maximum value of a coin. This lowers the perceived price of every similar coin, causing a downward spiral in values. This is particularly prevalent in coins that are common and/or readily available in a variety of grades. The only way that I can think of to counteract this is to limit access to APR data which, of course, is the opposite of transparency.

The Challenge of Counterfeit Coins

Please offer your opinions about what you think is wrong with our hobby today. If you could turn back the hands of time and restore some hobby traditions of yesteryear, what would they be?

I tend to think rather positively about our hobby today, but there is one thing that is very troubling to me, and that is the problem of counterfeit coins. The motivation behind counterfeit coins is pure greed, both from the creator of the counterfeits and the person who knowingly handles them.

Counterfeit coins have always been with us – I remember them being a problem even when I first began collecting coins in the sixties, but it was always fairly easy to detect them. However, today counterfeiters are becoming so good that many of their coins are very hard to tell from real coins. Thankfully, this is another area where the reputable grading services shine. They weed out most of the bad coins that are submitted to them, and when they do make a mistake, they correct it. It’s like having insurance against the bad guys. So, while there are bad actors creating and selling counterfeit coins, we have the good guys trying their level best to protect us.

Though I have many great memories of past times and experiences in the coin market, I enjoy today’s coin market even more. If there is anything I miss, it’s the lack of good coins in circulation and the dwindling numbers of brick-and-mortar coin shops. When I was a kid, I could find all sorts of silver coins, Buffalo Nickels, Indian Head Cents, and other now obsolete coins in bankrolls. Today, it’s hard to find anything of value in circulating coins, and there’s no place where a kid can go to talk about coins, learn from a mentor, or experience the thrill of hefting a $20 gold piece that they can only dream of owning.

How do you explain the precipitous decline in value of many high-grade coins?

The coin market feels softer than a year ago, but I wouldn’t characterize it as a precipitous decline. Certain areas of the market are worse than others, but even generic gold is slightly higher than last year thanks to an increase in the price of gold. The PCGS3000 indices show varying results for different segments of the market. For example, its Silver and Gold Commemorative Index is down nearly 7% for the year, but the Proof Gold Index is up almost 2%. The overall market has been in a decline since November 2014, but prices seem to have plateaued for most segments in the last year or two. If money from the stock market begins flowing in again, we’ll be having a completely different, more positive, conversation.

Just like every other market, the coin market is subject to the laws of supply and demand. In the “modern” market (post-1964 coins), the problem is supply. Today’s “Finest Known” can easily become “Runner Up” as coins from the overhanging supply are graded and brought to market. Personally, I love the beauty and impressive quality of an MS- or PR-70 coin but I have to understand that my purchase price may be at risk if fifty or one hundred or even one thousand more become available tomorrow.

The market will always find equilibrium, but preferably not at my or your expense. In vintage (pre-1965 coins), declining prices seem to be caused by a simultaneous decrease in demand (i.e. fewer collectors) and an increase in supply as old-time collections have come on the market. This has created some great opportunities to buy wonderful rarities at advantageous prices.