By Mike Fuljenz

Gold closed 2018 at its highest price since June 15th, moving in the opposite direction of stocks, which fell the most of any December since 1931. During the fourth quarter, the S&P 500 lost 14% while gold gained 8%.

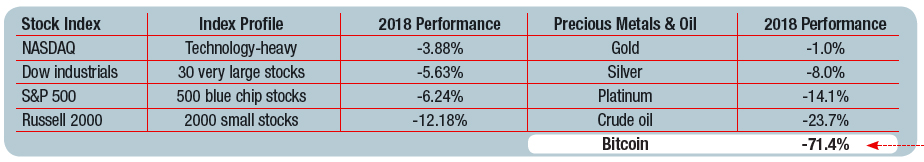

During the month of December, gold rose $65 an ounce (+5.4%) while the S&P 500 fell 9.2%. As of September 30, 2018, the S&P 500 was up 9% for the year, while gold was down 8.4%. Their roles later reversed, however, with gold gaining 8.1% versus declines in stocks ranging from -11.8% (Dow Jones) to -17.5% (NASDAQ).

The brightest side of gold’s performance story in 2018 is in terms of other currencies. Most foreign stock markets have fallen further than the U.S. stock market, and gold is up in most foreign currencies. The U.S. dollar was up about 5% in 2018, sending most commodities down in dollar terms. With gold down 1% in dollar terms, that means it averaged about +4% in terms of the euro and most other currencies. It gained double-digit percentages against troubled emerging market currencies, such as the Turkish lira or Argentine peso. Nothing gained much in 2018 except some less widely held metals such as rhodium and palladium. Bitcoin lost 71.4%.

Barron’s “Commodities Corner” column covered silver in December. Author Myra Saefong says silver now “deserves a second look” since “silver prices look to be a bargain, sitting close to their lowest levels in nearly three years.” As we have been saying here, silver is a double-play investment, a “hybrid” metal, serving as a precious metal used historically in coins and also in several important industrial applications. The portion of silver demand from industry is now at 65% and rising. As we have reported before, silver’s cutting-edge uses are in solar energy panels, photovoltaic cells and many promising electrical applications.

Barron’s notes there’s also a dramatic rise in investment demand. The U.S. Mint sold 242% more silver American Eagles in September through November in 2018 than in 2017, so many investors see what Barron’s is seeing – that silver is a bargain now.

Most major banks and investment houses haven’t issued fresh gold price projections since last October, but we should see quite a few in the next month. Back on October 30, at the annual meeting of the London Bullion Market Association held in Boston, the average predicted price for gold 12 months from that date was $1,532, a huge 25% gain from the $1,230 price at the time. That was a very unusual outcome, since the LBMA is noted for being very conservative in its price projections.

Last October, Germany’s Commerzbank predicted gold to rise to $1,300 by year-end 2018 (it came close) and $1,500 in 2019. It says that gold’s previous weakness was caused by the strong U.S. dollar, plus the strong U.S. stock market and weak emerging market currencies and global stock markets. As of last October, it saw those fundamentals changing, with the dollar declining along with U.S. stocks, giving gold a boost.

The Dutch bank ABN Amro sees gold and silver rising steadily throughout 2019, with gold reaching $1,400 and silver $18.00 at the end of 2019, with each quarter rising steadily throughout the year. Canada’s TD Bank sees gold at $1,375 to $1,400 in late 2019. Stateside, Bank of America Merrill Lynch said that gold could average $1,350 an ounce in 2019 due to widening budget deficits, due to the recent tax cuts. Its head of global commodities and derivatives research, Francisco Blanch, said that we’re still pretty constructive longer term on gold, because, in the long run, a huge U.S. government budget deficit is pretty positive for gold.

Mike Fuljenz, president of Universal Coin & Bullion in Beaumont, Texas, is a leading coin expert and market analyst whose insightful writing and consumer advocacy have earned major honors from the ANA, PNG, NLG, and the Press Club of Southeast Texas.

Want to receive COINage magazine in your mailbox or inbox? Subscribe today!