By Steve Voynick

Editor’s Note: This is the second in a two-part series about nickel mining and coin minting. Check out Part I >>>.

When the three-cent nickel, unpopular because it didn’t fit with the decimal system, was discontinued in 1889, the name “nickel” was used exclusively for the five-cent coin and has been since. Meanwhile, a few other nations were adopting nickel coinage. In 1881, Switzerland issued a 20-centime coin made of pure nickel, while several other European countries began issuing pure-nickel or cupronickel coinage.

Through the 1880s, coinage made up a significant part of nickel’s still-limited demand. In industrial use, however, the material was still only a minor alloying metal. But alloying technology was rapidly advancing, and metallurgists already knew of the excellent corrosion-resistance of chromium-steel alloys, in which surface chromium reacted with atmospheric oxygen to form a thin layer of inert chromium oxide to protect the underlying steel. But while chromium-steel had great industrial potential, it was brittle and difficult to work.

In 1889 metallurgists found that adding nickel to chromium steel

(Wikimedia Commons)

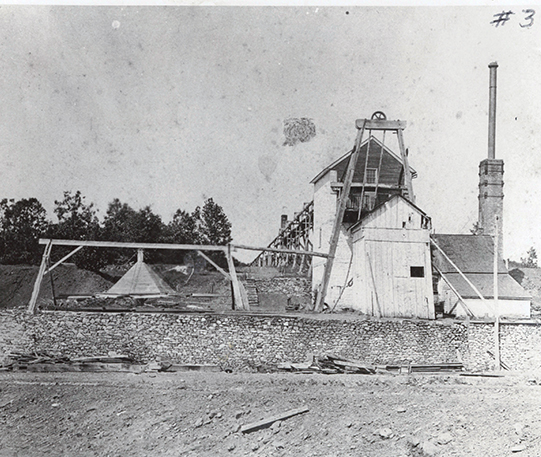

increased corrosion-resistance. Also, it was discovered that it significantly improved malleability, durability, and overall strength. Chromium-nickel steel, now called “stainless steel,” revolutionized the steel-making industry and made nickel a bona fide industrial metal with rapidly increasing value and demand. By 1890, New Caledonia, a French dependency in the southwestern Pacific, had displaced Norway as the leading source of nickel. A decade later, Canada took the lead after developing massive nickel deposits in Ontario’s Sudbury Basin.

During World War I, nickel-steel alloys became critical for the manufacture of gun barrels and armor plates. Canada stepped up production to 46,000 tonnes of nickel per year, while Germany, without any nickel resources, resorted to daring military operations to obtain small supplies. Nickel discoveries in the 1920s included the great deposits at Norilsk-Talhakh in the Soviet Union and the Merensky Reef in South Africa. Meanwhile, nickel-steel alloys continued to find new uses, notably in the cylinder heads and pistons of high-performance, internal-combustion engines, where few other alloys could endure the prolonged high-temperature stresses. During World War II, when nickel demand far exceeded supply, the United States War Production Board declared the metal a strategic material and restricted nonmilitary uses, including the Jefferson nickel production.

In October 1942, the Mint replaced the 75-25 cupronickel alloy in the Jefferson nickel with a 56-35-9 copper-silver-manganese alloy. The reverse of these “wartime nickels” carried a prominent “P” mintmark over Monticello’s image, the first use ever of the Philadelphia mint mark that was intended to aid in the planned postwar sorting and withdrawal of the coins. Production of wartime nickels conserved 1,100 tonnes of nickel, a relatively minor contribution to the war effort. Nevertheless, wartime nickels served as a highly publicized example of the sacrifices necessary for victory. The Jefferson nickel returned to its regular cupronickel composition in 1946.

Canadian nickels, minted from 1922 to 1942 and from 1946 to 1952, consisted of pure nickel. In 1951, a unique design commemorated the 200th anniversary of Alex Fredrik Cronstedt’s scientific discovery of nickel. The reverse depicted the towering smokestack of a Sudbury nickel smelter with the word “NICKEL” in bold letters and the dates “1751-1951.” This design would be reproduced in stainless steel in 1964 as a 30-foot-high monument that still stands in Sudbury today.

COINAGE ACT OF 1965 TAKES SHAPE

In the early 1960s, the intrinsic value of circulating U.S. silver coinage began to exceed its face value. To counter rampant hoarding, Congress passed the Coinage Act of 1965 that authorized the immediate withdrawal of silver from dimes and quarters, and a belated withdrawal from half-dollars. These were replaced by “clad” coins consisting of a copper core “sandwiched” between layers of 75-25 cupronickel and with an overall 91.7-8.3 copper-nickel composition. Ahead of the Coinage Act of 1965, about 500 tonnes of nickel went into the production of the Jefferson nickel each year. But by the early 1970s, the Mint’s use of nickel in nickels, dimes, quarters, and half-dollars had soared to 2,500 tonnes.

Another boost in nickel usage came with the 1998-2008 “50 State Quarters Program,” during which the Mint turned out 36 billion commemorative quarters. In 2006 alone, the Mint used 1,380 tonnes of nickel in 2.9 million quarters of five commemorative designs. Industrial demand for the metal had surged during the 1990s, thanks to the rapid development of China’s economy and its need for vast tonnages of stainless-steel and nickel-steel alloys. Nickel mines around the world ramped up to keep pace with the growing demand. But by 2000, the market oversupply had depressed the nickel price to only $3 per pound.

(Wikimedia Commons)

Mines then cut production—while nickel demand continued to grow. By the end of 2006, when nickel stocks had dropped below critical levels, panic buying drove the price of the metal to $23.60 per pound, pushing the melt value of the Jefferson nickel well above its face value. To prevent hoarding, the Mint issued a 2007 ruling that criminalized the exportation or melting of U.S. nickels and cents. Rising zinc prices had also created a similar problem with the cent. But mine production quickly caught up with demand, and nickel prices dropped to their previous levels.

With nickel now selling for $6.50 per pound and copper for $2.78 per pound, the Jefferson nickel’s melt value is just over four cents. Today, coinage comprises only a tiny fraction of global nickel demand. Stainless-steel, nickel-steel, and specialty alloys account for 86 percent of demand and electroplating and battery applications for another ten percent. The use of nickel in batteries is rapidly increasing. Nickel is essential to the lithium-ion batteries that power electric vehicles; the batteries in a single electric vehicle can contain as many as 90 pounds of nickel.

According to the United States Geological Survey, 25 nations now collectively mine 2.7 million tonnes of nickel each year. Australia, Indonesia, Russia, South Africa, and Canada account for half the global production. The United States, as of July 2020, has only one primary nickel mine that produces 14,000 tonnes of nickel annually, along with lesser amounts of by-product copper. Although the U.S. obtains additional nickel through recycling and as a by-product of base-metal and platinum mining, it depends on foreign sources for most of its nickel supply.

The Nickel Institute, a global association of nickel producers, estimates that 80 percent of all the nickel mined throughout history has been mined in just the last 30 years. Despite today’s nickel-mining boom, experts do not foresee a shortage of the metal. Global ore reserves now contain 300 million tonnes of nickel, and most of it is shallow laterite ores. At the current rate of mining, these reserves will last more than 100 years. And new nickel deposits continue to be discovered and developed.

The U.S. Mint now uses 4,400 tonnes of nickel each year in its circulating coinage, more than any other nation. Nickel also appears in foreign coinage such as the one Euro, Britain’s two-pound, India’s 10-rupee, Hong Kong’s 10-dollar, South Africa’s five-rand, and Chile’s 500-peso coins, all containing between 8 and 17 percent nickel. Switzerland’s circulating coinage consists almost entirely of 75-25 cupronickel. Canada’s Voyageur “silver” dollar, minted from 1968-1987, consists of pure nickel, and the one-dollar “loonie,” created between 1987 and 2011, contains 91.5 percent nickel.

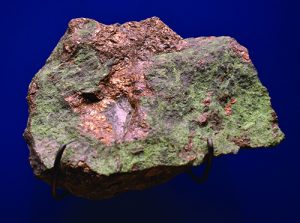

Over the past 180 years, nickel’s stature as a coinage metal has grown

(Wikimedia Commons)

immeasurably. Production of the 1857 Flying Eagle cent —the first use of nickel in modern circulating coinage—required 9.8 tonnes of nickel. Today, an estimated 20,000 tonnes are used each year to produce the world’s circulating coinage.

When it comes to coinage, the price will determine the future of nickel. Considering the metal’s growing industrial demand and projected higher prices, many analysts suggest that nickel will price itself out of circulating coinage in as little as a decade and possibly be replaced by nickel-plated steel coins.

Although nickel will never achieve the legendary coinage-metal status or familiarity of gold, silver, or copper, it nevertheless has quite a story of its own—as the nickel behind the nickel.