By Steve Voynick

Palladium has hung around as platinum’s “little brother” for a long time. Although it shares the same silvery-white color, it has never enjoyed platinum’s glamour, name recognition, and value. But now it appears that the “little brother” has suddenly grown up.

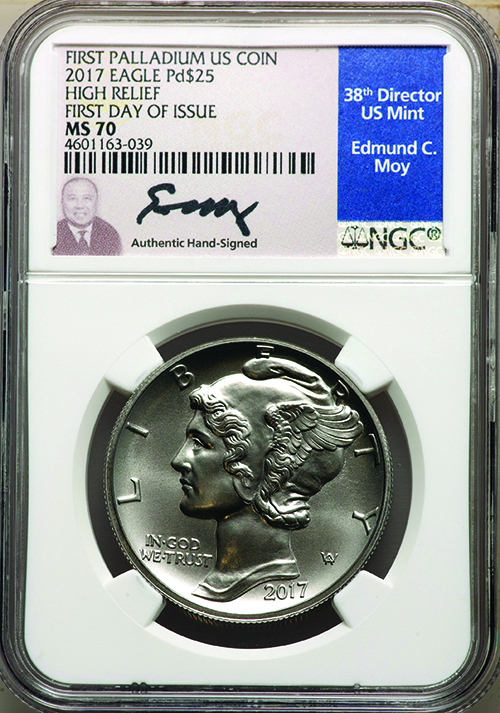

The four major precious investment metals—gold, silver, platinum, and palladium—have all performed well over the past five years. Silver has doubled in value, while the prices of gold and platinum have nearly doubled. But the standout has been palladium. In February 2016, palladium sold for $500 per troy ounce. Today, in April 2021, it’s selling for about $3,000 per troy ounce—a five-fold increase in just five years. And those who acquired American Eagle Palladium bullion coins when they were introduced in 2017 by the U.S. Mint doubtlessly wish they had bought more.

A long-term shortfall combined with steadily increasing demand has pushed palladium’s price to twice that of platinum, leading some metal-market analysts to predict a price of $3,000 per troy ounce by the end of 2021. But before looking to the future, let’s look at the metal itself.

PALLADIUM’S COMPOSITION

Palladium, chemical symbol Pd, is a rare, silvery-white, transition metal. With a specific gravity of 12.02, it is as dense as lead but only half as dense as platinum. Harder than both gold and platinum, it takes a superb polish. Although not quite as inert as gold, palladium nevertheless does not oxidize under normal conditions and, like platinum, retains its gleaming metallic luster indefinitely.

Palladium and five other rare, chemically similar metals—platinum, ruthenium, osmium, iridium, and rhodium—are known as the platinum-group metals or “PGMs.” Palladium and platinum, the most common of the PGMs, are both 20 to 30 times rarer than gold.

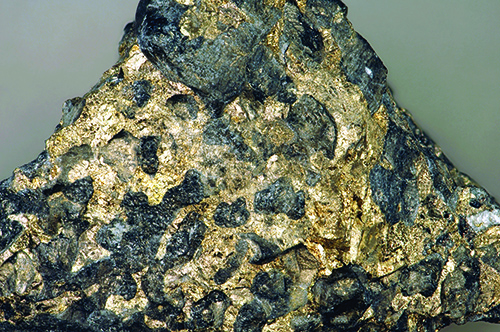

With their mutual chemical affinities, the PGMs always occur together in the same mineral deposits, either as native PGM alloys or compound minerals. PGMs have two basic sources: PGM deposits in which either palladium or platinum is the metal of primary economic importance, or deposits of nickel ores that yield by-product PGMs.

DISCOVERY IN COLOMBIA

Palladium’s story begins in the 1500s when Spanish gold miners found PGM nuggets and grains in gold placers in what is now Colombia. But PGMs then had neither use nor value, and their great density made them difficult to separate from gold. The Spanish named the strange metal platina, a derogatory term meaning “little silver.” During the early 1600s, workers at Spain’s royal mint at Santa Fé de Bogotá (in present-day Bogotá, Colombia) dumped large quantities of then-worthless platina into the Río Bogotá. In 1670, metallurgists found that small amounts of platina alloyed with bronze enhanced the hardness and durability of naval cannons. By 1700, they had learned that adding arsenic reduced platina’s high melting point and increased its workability.

The next revelation was that gold, when alloyed with platina, changed little in color and weight. Realizing that platina was an ideal gold-counterfeiting agent, mint workers began adulterating Spanish gold coins with platina and pocketing the displaced gold. To suppress this rampant counterfeiting, the Spanish Crown banned private possession of platina under penalty of death. But when counterfeiting continued, the Crown offered a bounty for all platina turned in—the first formal PGM valuation.

But the Crown itself even stooped to counterfeiting by later ordering certain issues of its own gold coinage debased with platina, then using those issues to pay off foreign debts. In the early 1800s, English chemists William Wollaston and Smithson Tennant showed that platina was not a single element as previously believed but an alloy of several related metals. They isolated palladium, rhodium, iridium, osmium, and platinum, naming the latter after the original platina.

Wollaston named palladium after the recently discovered asteroid 2 Pallas, a name derived from a Greek goddess. Wollaston’s experiments yielded small amounts of palladium, which he surreptitiously marketed as “new silver,” a fraud that his peers soon exposed.

In 1824, Russian prospectors discovered rich PGM placer deposits at Nizhne-Tagilsk in the Ural Mountains. The Russian government quickly monopolized mining and refining, then began fabricating platinum jewelry and minting legal-tender platinum ruble coins. The Russian mint often adulterated its platinum coins with considerable amounts of still-worthless palladium.

EARLY SCIENTIFIC USE

European scientists in the 1850s utilized the high melting points and chemical inertness of palladium and platinum to make laboratory crucibles, thus creating the first limited industrial demand for the metals. By the 1890s, researchers had discovered that palladium and platinum had catalytic properties that accelerated certain chemical reactions. The two metals quickly became standard industrial catalysts for acid manufacturing and petroleum “cracking.” After 1900, platinum began to gain popularity as a jewelry metal in the United States and Europe.

Prior to World War I, palladium and platinum came only from Colombian and Russian placer deposits. With their limited uses, both metals sold for about $25 per troy ounce. But wartime catalyst demand for liquid-fuel production soon drove their prices above $100 per troy ounce. Meanwhile, the metals also found their first electrical use as electrodes in aircraft-engine spark plugs.

ICONIC SOUTH AFRICAN DISCOVERY

In 1924, South African geologist Hans Merensky made the greatest PGM discovery ever—the deep, layered, PGM-enriched igneous deposits of South Africa’s Bushveld Igneous Complex. The three major Bushveld deposits—the Merensky, Platreef, and UG2 reefs—were quickly developed as underground mines.

In the 1930s, palladium was being alloyed with gold to create “white gold,” a popular jewelry-metal alternative to the more expensive platinum. When platinum became a strategic metal and was withdrawn from civilian use during World War II, palladium replaced platinum in the manufacture of jewelry. Although the much harder palladium jewelry resisted scratching, its lower density lacked the authoritative “heft” of both platinum and gold that consumers had come to expect. Palladium’s biggest marketing problem as a jewelry metal, however, was its lack of name recognition.

During the 1950s and 1960s, platinum prices stabilized at about $100 per troy ounce, roughly three times that of gold. Palladium, meanwhile, held steady at $30 per troy ounce and received little attention.

MODERN USES AND MINING

The modern era for both palladium and platinum dawned in the early 1970s, when government-mandated reductions in automotive-exhaust emissions required that all new automobiles be equipped with catalytic converters to break down noxious hydrocarbon and nitrous-oxide exhaust emissions. Each converter contained between one-quarter and one-half troy ounce of palladium or platinum in a ceramic honeycomb called “autocatalyst.” By 1980, autocatalyst demand had driven platinum’s price to $160 per troy ounce and palladium’s price to $100.

In autocatalyst use, palladium is more efficient in converting gasoline exhaust, while platinum functions best with diesel exhaust, but the two metals do have some degree of interchangeability. Whenever possible, catalytic-converter manufacturers maximized the use of whichever metal was cheaper while still meeting the mandated standards of conversion efficiency. Autocatalyst use remains the primary driver behind palladium and platinum demand today. In 2020, autocatalyst manufacturing accounted for 84 percent of the total palladium demand of 9.9 million troy ounces. Industrial uses, mainly as chemical catalysts and electronic components, took another 15 percent. The manufacture of jewelry and investment products like coins and bars amounted to only one percent of palladium demand.

The 2020 mine supply of palladium amounted to 6.2 million troy ounces, while recycled autocatalyst, jewelry, and electronic components provided another 3.1 million troy ounces. Nevertheless, the total 2020 palladium supply of 9.3 million troy ounces fell 600,000 troy ounces short of demand.

Three quarters of all newly mined palladium comes from just two nations—Russia, with 44 percent of world production, and South Africa with 32 percent. Russia obtains its palladium as a by-product of nickel mining at the Norilsk Nickel multi-metal complex. South Africa’s palladium comes from a dozen deep PGM mines and two open pits in the Bushveld Igneous Complex. But production reliability remains uncertain because of Norilsk Nickel’s technical issues and South Africa’s labor unrest. Canada ranks third with seven percent of world production, recovering palladium from the Lac des Iles PGM mine and also as a by-product of nickel mining. The United States is fourth with three percent of global output, thanks to the Stillwater Mine at Stillwater, Montana.

The Stillwater deposit, known as the J-M (Johns-Manville) Reef, is the world’s richest (but not largest) PGM source. Geologists discovered the deposit after a decade of exploration within the Stillwater Complex, a deep, 30-mile-long, layered intrusion. The J-M Reef is a six-foot-thick, four-mile-long layer grading 0.7 troy ounces of PGMs per ton in a 3.6:1 palladium-platinum ratio. Now a property of Sibanye-Stillwater (a subsidiary of Johannesburg, South Africa-based SibanyeGold), the Stillwater Mine has two deep underground operations. Annual production includes 470,000 troy ounces of palladium, which is virtually the nation’s entire production. But with domestic annual demand at 3.5 million troy ounces, the U.S. remains heavily dependent upon foreign palladium.

PGM ores vary widely in their palladium-platinum ratios, even among ores from the same deposit. In most years, global palladium production slightly exceeds that of platinum. Generally speaking, North American ores are palladium-rich; South African and Russian ores are platinum-rich. PGM milling is similar to the milling of other metal-sulfide ores. Crushed ore is ground to a powder and put through a flotation-separation process to yield a sulfide concentrate of PGMs and by-product amounts of gold, silver, copper, and nickel. This concentrate is then smelted into a mass of mixed metal from which the PGMs are separated and refined.

Even with recently increased investor demand, only 90,000 troy ounces of palladium went into coins and bars in 2020, not much compared with the one million troy ounces of platinum that went into investment products. The West African nation of Sierra Leone introduced the first palladium coins in 1966. The first major issue arrived in 1989 with the Russian Palladium Ballerina. Other issues followed, among them the Australian Palladium Emu and the Chinese Palladium Panda. Still minted today are the Canadian Palladium Maple Leaf, first issued in 2005, and the U.S. American Palladium Eagle, introduced in 2017. To date, these issues have all been relatively small, not exceeding 30,000 coins per year.

Density differences are readily apparent when comparing the American Palladium Eagle with the Platinum Eagle, both of which contain one troy ounce of .9995-fine palladium and platinum respectively. The Platinum Eagle has a 32.7-millimeter diameter and a 2.39-millimeter thickness; the larger, high-relief Palladium Eagle has a 34.04-millimeter diameter and a 3.5-millimeter thickness.

RISING PRICE

Palladium’s five-fold increase in value over the past five years is even more impressive considering the 2020 COVID pandemic-related supply-demand disruption. COVID mining restrictions reduced palladium mine supply by 10 percent, while a 15 percent COVID-related drop in global auto production subsequently reduced demand. Yet palladium prices still rose 18 percent during 2020, leading some analysts to suggest that without the COVID disruption, the price of palladium would have already reached $3,000 per troy ounce. An expected easing of COVID restrictions during the second half of 2021 should increase the palladium mine supply. Meanwhile, a projected a major recovery in global auto manufacturing, further tightening of automotive-exhaust restrictions, and a continued shift in small-vehicle engines from diesel to gasoline will combine to boost palladium demand.

How will this short-term supply-demand picture impact palladium prices? In February, the independent precious metals research group Metals Focus reported: “The recovery this year in [palladium] mine supply and expectations of increasing recycling will not offset growth in demand, resulting in the tenth consecutive physical deficit in 2021.”

Eyeing the likely recovery in palladium demand, many forecasters are predicting palladium prices to hit $3,000 per troy ounce by the end of 2021. But not everyone agrees. Some see resistance already shaping up at the current price of $2,500 per troy ounce as autocatalyst manufacturers attempt to shift their PGM usage away from palladium and toward less costly platinum.

Because of its low production and limited number of mines, palladium supply remains particularly vulnerable to mining disruptions. Unlike gold, which has huge surface stockpiles, palladium stockpiles amount only to about one year of mine production. A significant decline at just one major palladium mine would dramatically impact the metal’s price. Over the long term, the greatest threat to palladium (and platinum) prices would be massive use of electric vehicles, which would destroy the PGM market. But most analysts are confident that diesel- and gasoline-powered vehicles will remain dominant at least for the next decade, thereby sustaining PGM demand.

We can visualize palladium’s rarity relative to gold by comparing historic mined volumes. The United States Geological Survey reports that the world’s cumulative gold production of 6.35 billion troy ounces would occupy a 71-foot cube. All the PGMs ever mined—less than 500 million troy ounces—would occupy only a 14-foot cube. Historic palladium production, even compensating for the metal’s substantially lower density and subsequent greater volume, would only occupy an 11-foot cube.

For the past two decades, PGM mine production has held steady near its historic high, usually varying less than five percent from year to year. Although the world has less than 20 significant PGM sources, ore reserves are surprisingly large and sufficient for several more decades at the current rate of mining. The only major new PGM mine currently under development in South Africa will not greatly impact global mine supply.

With many analysts predicting $3,000-per-troy-ounce palladium within a year, it seems that, certainly as an investment metal, platinum’s “little brother” has indeed grown up.