In December 1979, Russia invaded Afghanistan amid high and rising inflation and that act pushed gold from barely $400 per ounce to $850 per ounce within a month. One untold story of Russia’s invasion of Ukraine is that Russia has been stockpiling gold regularly over the past decade – like no other nation –even though it is a relatively poor nation, about on par or a bit above Spain. Russia likely did this since it probably knew gold would soar after its aggressive actions, offsetting any possible loss in future energy sales. In 2010, gold represented only 7.4% of Russia’s official foreign exchange reserves. By 2019, that share had more than tripled to 23.4%. Russia funded this by unloading its U.S. dollar holdings.

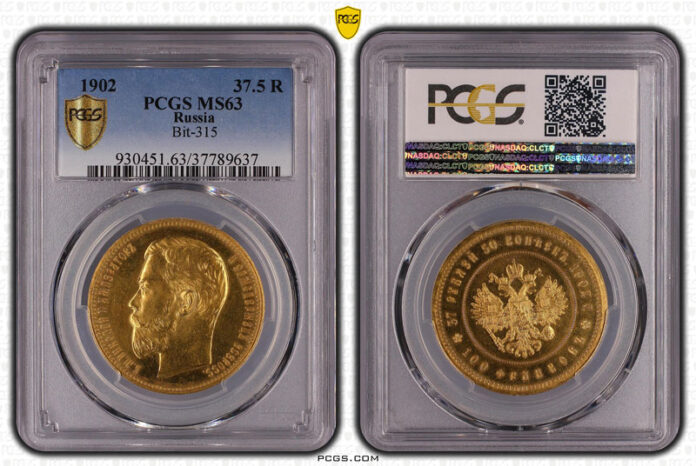

COURTESY PCGS.COM

Russia Leapfrogs to Rank Number Five in Gold Holdings

This gold-purchasing program has pushed Russia’s gold hoard to the number five position in the world, not far from number three, behind only the U.S. and Germany. Russia now holds 2,300 metric tons of gold according to the World Gold Council (WGC). At today’s price, that’s about $145 billion, which equals about 10% of Russia’s GDP.

Gold is fungible everywhere. Russia’s stockpile of gold, if sold to a friendly country such as China, could help offset, in whole or in part, monetary sanctions.

Russia has had a long-time fascination with gold. Its appreciation of gold dates back to at least the 1880s under Czar Alexander III. Paper money came into play in Russia in 1775 under Empress Catherine the Great.

Paper money was a curse of the Russian economy for the next 100 years.

Alexander III was dissatisfied with paper money, and he started a process that later put Russia on a gold standard under his son, Czar Nicholas II, in 1897.

World War I interfered with Russia’s gold standard, as it had to revert to paper money in 1915 that was not backed by gold. In the 1920s and 1930s, the Soviet government began amassing gold again, this time under Joseph Stalin. The paper standard continued, but Russia had quite a bit of gold. The amount of gold held was a closely guarded secret held by top-level officials. Russian coin expert R.W. Julian says that during this time, it would have been unlikely for Russia to have sold any of its gold.

Russia Stockpiles Gold in the 1970s and 1980s

Russia’s stockpiling of gold continued until the 1970s and 1980s. Julian speculates that beginning in the 1970s, Russia began exchanging its gold to pay foreign debt.

In the 1990s as a result of Communism’s elimination, it would follow that it sold off gold to pay debts.

Vladimir Putin, with titles changing but power remaining, has been in control of Russia since about 2000. Over the last decade, that power has transitioned to being absolute. It’s speculated that Putin thinks that gold is the best asset to own during difficult times. Julian says that Putin’s affinity for gold likely has led to him laying away a significant amount for himself.

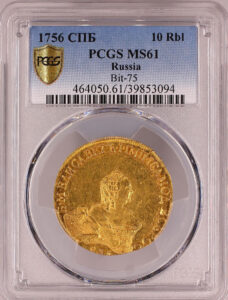

COURTESY PCGS.COM

Collectible Gold Coins of Russia

Russia has struck gold coins since the 1700s. These coins are highly collectible, especially the early ones. In fact, all Russian gold coins of the 18th century are highly popular with collectors. The Professional Coin Grading Service (PCGS) and Numismatic Guaranty Company (NGC) certify and grade these early Russian gold coins, which are frequently sold at public auctions and by online auction facilitators for handsome sums.

Julian speculates that modern gold coins struck by the mints of Russia are not being let out of the country at this time. Since Russia isn’t parting with its gold, it would follow that these modern gold coins are not going to be readily available in the U.S.

First Two Months of 2022

All of the precious metals are on the positive ground after just two months of 2022. With approximately 5% gains – and even more after March 1 – the major stock market indexes are down an average of 8%, and even more after March 1. And the indexes sank further on the increasingly fearful news coming out of Ukraine.

In the first two months of 2022, U.S. Mint sales were down (year over year) for the American Eagle gold and silver coins – down 21.7% for Gold American Eagles and down 18.4% for Silver American Eagles. This is partly because 2021 was a banner year of sales growth for the Eagle pattern design change, but American gold Buffalo one-ounce coin sales rose 65.6% in February vs. February 2021, partially offsetting lower Eagle sales.

Gold in the Long Term

Inflation will come and go. It is rising now.

It will eventually come back down, but the debt will keep rising, and it will eventually be either repudiated (through non-payment) or be purposefully “devalued” through a process called “monetization,” or printing more money to pay the debt.

Columnist George Will wrote about debt recently, commemorating that the U.S. had just passed the $30 trillion national debt mark after passing the $25 trillion mark less than two years ago.

It’s almost impossible to imagine a number that big, but in human terms, $30 trillion amounts to about $90,000 in debt for each American or $360,000 for a family of four.

On a national scale, each 0.25% increase in the Fed funds rate amounts to a $75 billion increase in the cost of servicing the federal debt. So if the Fed enacts four 0.25% rate increases this year, that will cause a $300 billion cost increase for nothing more than writing checks to big banks, foreigners and rich investors who hold Treasury notes.

Will stated: “An average rate of just 5% — which Washington was paying in 2008 — combined with merely modest new federal spending, would push the debt toward 300% of GDP in three decades.” Today’s federal debt equals 100% of GDP, or 161% if state and local debt is included. And aging Baby Boomers, with fewer younger workers, will also push Social Security and Medicare toward bankruptcy.

Will concludes: “Even an interest rate of just 3 percent on debt at 250 percent of GDP would siphon up approximately 40 percent of tax revenue. Inflation amounts to repudiation, paying debts in devalued dollars, and as debt increases, so does the government’s incentive to choose inflation.”

Three Planning Principles for Owning Gold and Rare Coins

1. Don’t put all your eggs in one basket.

I urge investors typically not to put more than an allocated portion of their investible dollars in any one investment category such as stocks, bonds, certificates of deposit, real estate and gold coins. I also recommend that before anyone invests, a professional financial advisor should be consulted. It’s important to have a wide variety of investments, where one class of investments can “zig” while the others “zag.” Very often, your stocks will fall while gold rises, while the opposite might happen at other times.

2. There is no Santa Claus in numismatics.

If you see a rare coin for sale at a substantial discount from its normal price, do not expect a bargain. It may be a falsely graded coin, a counterfeit, or a fraud. I recently heard from a collector who sent me some $2.50 Indian gold coins graded by a company with some letters that were very close to “PCGS” or “NGC,” but were not the precise letters of those respected grading services. The coins were graded MS-65 by this second-rate grading service and were not even worthy of an MS-60 grade, in my view. Since the coins were subject to a 15-day money-back guarantee, I urged this client to ask for his money back, or to seek legal aid, or further help, if that were no longer possible. Be wary of something that seems “too good to be true,” since it probably is.

3. Buy quality coins from someone known for expertise in the field.

Sometimes, you may pay a little bit more for the same grade rare or antique coin from a recognized expert in the field, but you will also likely fetch more for that coin later on when you go to sell it because the expert is selling you a “sight seen” coin, selected as a better coin, not a generic “sight unseen” coin marketed by so many other dealers who do not have the expertise or take the time to select the better coins in the field.

This article about Russian gold stockpiles previously appeared in COINage magazine. To subscribe click here. Article by Mike Fuljenz.