By Mark Lovmo

For world coin enthusiasts who pursue modern-era issues, there are two common frustrations that discourage them from collecting the coins of certain countries.

One is difficulty in gaining knowledge of these countries’ modern series of coins beyond the information available in a world-coin compendium such as the Standard Catalog of World Coins. The other frustration is the inability to gain a complete understanding of the markets in which these coins are bought and sold.

These problems invariably involve world coins that might not be popular in one’s own numismatic community, and they especially apply to coins that do not have an easily accessible base of literature.

This last point might be due to the fact that when relevant numismatic information does indeed exist, it might be limited to the coins’ country of origin and might be written in an unfamiliar foreign language.

Understanding Challenges and Solutions

In such cases, language barriers and access rights can restrict our ability to view catalogs, price guides and online numismatic retail and forum sites that might contain valuable information about these coins.

This article is an attempt to address just one country’s modern series of coins for which all of these issues pertain: the coins of South Korea.

South Korean Coin Production

After gaining independence from the Empire of Japan in 1945 and the establishment of its government in 1948, South Korea issued its very first coins during the last years of the nation’s second currency, the hwan (1953-1962).

Without a mint of its own, South Korea imported all three of the nation’s hwan coins from the United States. These coins were manufactured at the U.S. mint in Philadelphia from 1959 to 1962 in denominations of 10, 50 and 100 hwan.

A currency reform in June 1962 changed the name of the currency to the won (1962-present), but it also allowed for the continued circulation of the 10-hwan and 50-hwan coins, which were revalued downward to one won and five won, respectively. Only the 100-hwan coins were demonetized, removed from circulation and melted.

Investing in Minting

The Korean government soon began making increasingly sizable investments in the South Korean Mint, in part to facilitate the growth of the local economy by revamping the domestic currency system. These efforts resulted in the construction of a mint near the southeastern coastal city of Busan in 1966, which began the first domestic production of circulation coins in South Korea.

Three new copper-based coins were minted in denominations of one won, five won and 10 won, and these began replacing paper currencies of the same values.

A huge expansion in the mintages of these new won-denominated coins after 1968—helped along by a switch to less expensive coining metals—started to alleviate the growing domestic need for smaller-denomination currency.

Revamping the System

The government continued its overhaul of the currency system by replacing other

lower-denomination bank notes with coins, resulting in the introduction of new cupronickel pieces: the 100-won coin in 1970, the 50-won coin in 1972 and finally, the 500-won coin in 1982.

In 1975, the Korean government constructed a new minting facility in the city of Gyeongsan and deactivated the mint near Busan that same year. The new facility allowed the South Korean Mint to expand operations to include the striking of commemorative coins and medals (which also began in 1975), as well as take on larger contracts to manufacture coins and currencies for foreign nations.

Collector Markets

The business-strike coins that collectors consider to be key-date pieces are the copper-based coins: The 10-hwan coin (KM#1) with the “4292” Korean Era date; the 10-won coins (KM#6) dated 1966 through 1970 and 1975; the five-won coins (KM#5) dated 1966 and 1967; and the one-won coins (KM#4) dated 1966.

A few of the early cupronickel pieces also are considered key-date coins: The 100-won coins (KM#9) dated 1970, 1971, 1972 and 1974; the 50-won coins (KM#20) dated 1972 and 1973; and the 500-won coins (KM#27) dated 1987 and 1998.

Although some pursue these coins in lower grades, serious South Korea enthusiasts prefer examples of these key-date coins in mint-state grades with good eye appeal. Collectors are particularly keen on key-date copper pieces that are free of excessive toning that usually appears in the form of brown spots. Such “spot-free” coins almost always command a premium. There are relatively few coins predating 1970 that third-party grading companies have graded Mint State 65 or higher.

Finding South Korean Coins Globally

Collectors who are able to explore the larger market for these coins soon begin to notice that many of the highest-graded key-date South Korean coins are to be found outside of Korea, with the majority in the United States. However, the emergence of online retail and auction sites has changed this situation to a certain extent in the last 15 years, with collectors and dealers in Korea acquiring some of the best examples of these coins from sellers in other countries.

Further examination of Korean sources also quickly reveals that prices for these coins in the South Korean collector market are notably higher than elsewhere. This is reflected in yearly coin-catalog listings by the two most prominent Korean-language publishers of numismatic literature, Daegwangsa and Ohsung K&C.

While these catalogs might cite rather hopeful prices, realized prices at online Korean coin retailers and in brick-and-mortar shops reveal unquestionably higher prices compared to similar, uncirculated key-date South Korean coins sold in North America.

Often, there is a two-fold difference in price. For years, Korea-based dealers have been turning decent profits by acquiring such coins from outside of Korea and selling them locally.

Examining Pricing Impact

I have become aware of only a few instances in the last seven years in which single, MS-grade South Korean circulation coins were sold for realized prices over $450 through online venues in North America. Most currently sell for prices ranging between $30 and $350.

As is the case with some other series of world coins, these values are quite elevated compared to prices just a few years ago. Until recently, the low prices listed in world coin catalogs for key-date South Korean coins might have led people to believe that the listed prices were the result of a sizable supply of high-grade examples when, in all likelihood, it was just the result of low demand outside of Korea.

While it is difficult to gauge the average condition of the existing examples, the evidence available suggests that such high-grade coins with good eye appeal are scarce, if not rare.

Although the market everywhere for these coins has leveled in the last five years, there still exists a radical mismatch in the prices paid for uncirculated key-date South Korean coins sold in Korea and those sold outside of Korea.

The Collector Community

By some measures, the numismatic community in South Korea is exceedingly small, yet its members are quite enthusiastic about Korean coins and notes from every historical era, including the contemporary coins of the Republic of Korea discussed in this article.

There also is great interest in world coins and bank notes. Among the most popular items are contemporary Euro-zone issues, Chinese silver, 20th-century U.S. coins and Meiji, Taisho and Showa-era issues from Japan. These coins and currencies are the most numerous non-Korean items at Korean coin shops and in retail listings online.

A national currency show known as the “Korea Money Fair” has been held yearly since 2010. This well-attended event is clear evidence of growing numismatic interest inside the country.

The uptick in numismatic interest is one reason why the major third-party grading companies are performing their own “pivot to Asia,” with submission centers in Seoul, as well as in other cities in East Asia.

Coin Grading

Third-party grading has become a fixture of the numismatic scene in South Korea at a level not often seen outside of North America, with certification holding sway over key-date coins. NGC has clearly cornered the market in South Korea, as the vast majority of certified Korean coins found in South Korean retail and auction venues are graded by NGC.

Currency retailers in South Korea often operate brick-and-mortar businesses that also have an online presence. The most prominent auction business in the country is Poongsan Hwadong (hwadong.com), which hosts important numismatic auctions at the annual Korea Money Fair and is also the international submission center for NGC in Korea.

Among the prominent retail businesses specializing in numismatics are Sujipbank (sujipbank.com), Power Coin (powercoin.co.kr), Sujipmol (sujipmol.com), Ohsung K&C (soojip.com), Mirine Mall (mirinemall.co.kr) and Nara Auction (narauction.com).

For non-Koreans, purchasing from these businesses is difficult, as their online stores are navigable only by those with knowledge of the Korean language and they take payment only in the form of funds drawn from local bank accounts and credit cards issued in Korea.

Online Club Prevalence

South Korea lacks a prominent, nationwide numismatic organization. Instead of a national organization, many in the collecting community are members of smaller currency clubs that are local or Web-based. Most of these currency clubs often operate as online forum sites at the Korean Web portals Daum, Naver or Nate.

The largest online club, True Colors of Collecting (http://cafe.naver.com/antimaker), boasts a membership of more than 39,000, and the next-largest club, Coins and Notes” (http://cafe.daum.net/dongjeonjeepea), has more than 17,000 members. Another club that specializes in world currency collecting is World Money (numerousmoney.com).

Memberships in these forums are often open to non-Koreans, although Korea-specific identification information might be required. With access and knowledge of the language, these sites offer a wealth of information about Korean numismatics.

As for North Korea, few people outside that secluded country know much about the numismatic scene there. However, low-mintage silver proof crowns and half-ounce gold and silver pieces are gaining popularity among world coin collectors outside of Korea.

The North Korean precious-metal coin mint, Korea Pugang Coins Corporation, has manufactured these coins since the late 1980s. In recent years, one frontier commodity investor, Jim Rogers, has been buying as many of these coins as he can in an effort to corner the market on them. He is betting that this investment will reap a profit in the event of a future collapse of the North Korean state.

Coins to Look For

(1) “Bronze”-variety 10-won coins (KM#6) dated 1970

These are possibly the most difficult South Korean coins to find in grades above MS-62. Be aware that halfway through the minting of the 1970 issues of the five-won and 10-won coins, the South Korean Mint changed the coining metal from the 88-percent copper, 12-percent zinc composition it had been using since 1966 to an alloy of 65 percent copper, 35 percent zinc.

Collectors and third-party grading companies denote the former as the “bronze” variety, and the latter version as the “brass” variety, although both are actually brass. Coins of the bronze variety often have a darker, golden color compared to those of the brass variety. Variety authentication is recommended.

The bronze-variety 1970 10-won coins in the grade of Mint State-64 have been fetching 800,000 KRW ($700 in U.S. dollars) in South Korea, while similar coins have a difficult time breaking the $450 mark outside of South Korea.

(2) 10-won coins (KM#6) dated 1969

This date is almost as difficult to find in brilliant uncirculated condition as the bronze 1970 piece. Coins free of brown toning are quite rare. In 2015, a very nice NGC-graded example in MS-64 sold in a Heritage auction for $282, while an NGC-graded example in MS-63 was sold by an online South Korean retailer for approximately $400.

(3) 10-hwan coins (KM#1) dated 4292 (1959)

In high grades, this coin is probably the most sought-after of all South Korea’s circulation coins. A South Korean retailer is selling an NGC-graded example in MS-64 Red for 590,000 KRW ($500), and another—also graded by NGC—in MS-65 Red for 920,000 KRW ($790).

By comparison, I purchased a PCGS-graded example in MS-64 Red for less than$180 on eBay in 2014.

Keep an eye out for 10-hwan coins countermarked with the Korean hangul letters for kyeon yang, meaning “specimen.” The Standard Catalog of World Coins describes these coins as “bank samples,” and these have sold at much higher prices than those without this countermark in the same condition. In 2015, a PCGS-graded 10-hwan specimen (KM#S1) in MS-62 Red-Brown sold for $400 on eBay.

(4) XXIV Summer Olympics commemoratives dated 1987 and 1988

The coins issued to commemorate the 1988 Seoul Summer Olympics are among the most familiar and omnipresent of all South Korean coins in numismatic markets worldwide.

Perhaps the scale of these commemorative issues might be some indication as to why this is so.

In 1987 and 1988, the Bank of Korea issued four separate sets of seven coins each, along with a single four-coin set, for a total of 32 coins composed of either gold, silver, nickel or copper-nickel.

Most of the coins were made in both mint and proof versions, with mintages of both often in the hundreds of thousands. After the glow of the Olympics had worn off the following year, the Bank of Korea found that it had a sizable portion of the total number these coins left unsold (over 2.5 million). Many retailers in the country began to ask that the bank buy back their own unsold stock.

Like many Olympic coins, the silver proofs appear for sale nowadays as some of the least expensive world coins of their type for their size and weight.

Other Rarities

Along with the other key-date business-strike coins mentioned at the beginning of this article, there are a few other South Korean numismatic rarities worth looking for. Any of the early (1975-1981) Bank of Korea commemorative coins minted in frosted proof are highly popular and number only 2,000 pieces each.

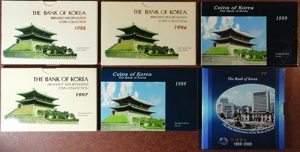

A frosted proof six-coin presentation set made in 1982 (KM# PS6) has sold for between $1,400 and $3,000. The 1987 Bank of Korea mint set, which includes a low-mintage 500-won coin, sells for upwards of $400 in Korea. The six-coin mint sets for the years 1995, 1996, 1997 and 1999 feature five-won and one-won coins that number only 10,000 to 15,000 pieces. These mint sets sell for between $150 and $400 in Korea.

The 500-won coin dated 1998 is the lowest-mintage South Korean coin ever issued as a business strike, at 8,000 pieces. They appear exclusively in 1998 Bank of Korea six-coin mint sets, with some having been broken out of their sets by collectors, usually for certified grading.

Focusing on Sets

Collectors in South Korea are snapping up these sets for 1,650,000 KRW ($1,400) as soon as they are listed by the popular online retailer, Sujipbank. Other popular, rare sets are the “foreign” mint sets, as the Koreans call them: These are Bank of Korea mint sets that can be distinguished by the complete absence of Korean hangul lettering, having only English writing on their cases and slip covers.

These sets are often mistaken for regular Bank of Korea mint sets in online auctions. Made each year from 2001 to the present, these sets sell for a premium over regular mint sets. The “foreign” mint sets made from 2001 to 2004 are especially prized in Korea since they feature reverse-proof coins, and only 3,000 to 5,000 of these sets were made.

Collectors are also quite interested in South Korea’s first commemorative coins, issued by Italcambio as six gold proof coins and six silver proof coins. Around 4,000 of each silver coin were made, while the four larger gold coins of this series number only in the hundreds.

Some of the gold coins feature the Paris Mint “cornucopia” mint mark, and these number only 402 pieces in total. These Paris Mint pieces are the lowest-mintage and highest-priced South Korean coins.

Uncommon Appeal

Collectors also have shown keen interest in an odd variety of the tiny 50-won silver coin (KM#7) from this series that is inexplicably dated “1971” while the rest of this commemorative series is dated “1970.” One of these coins sold at a 2015 eBay auction and topped out at $250.

It is hoped that this brief explanation of South Korean coins will encourage other world coin enthusiasts to overcome the barriers involved and explore foreign numismatic sources.

Even better, they could use their findings to add to the English-language numismatic literature on world coins, which is sorely lacking, considering the scale of the subject.

Future articles would be very helpful to explain the markets for world coins in their countries of origin, as well as to shed more light on the designs, manufacture and historical backgrounds of these modern series of world coins.